Craft is commerce, culture is capital, and India is ready to collect. You in?

TL;DR:

- From global IP filings to design patents and GI tags, Indian creators are now demanding visibility, locking in commercial value, and building brands rooted in identity.

- Consumers now ask not only what something is but also where it’s from and who made it.

- Storytelling isn’t mere fluff — it’s pricing power, brand identity and consumer connection.

–

For years, India served as the world’s embroidery room. It made luxury shimmer, turned sketches in European studios into runway sensations, and quietly built the craft that underpinned billion-dollar brands. But “Made in India” rarely made it to the credit list, let alone the tag.

That script is flipping fast. From global IP filings to design patents and GI tags, Indian creators are no longer content being the creative undercurrent. They're demanding visibility, locking in commercial value, and building brands rooted in identity. In a cultural economy where provenance sells and storytelling drives pricing, Indian brands have a shot at turning “Made in India” into a premium tag.

But they’ll need to act fast. From beauty to fashion to wellness, the global market is hungry for authentic stories, ethical sourcing, and cultural specificity. And that means branding the maker and not just their product.

INDIA’S FILING, FIGHTING, AND FLEXING

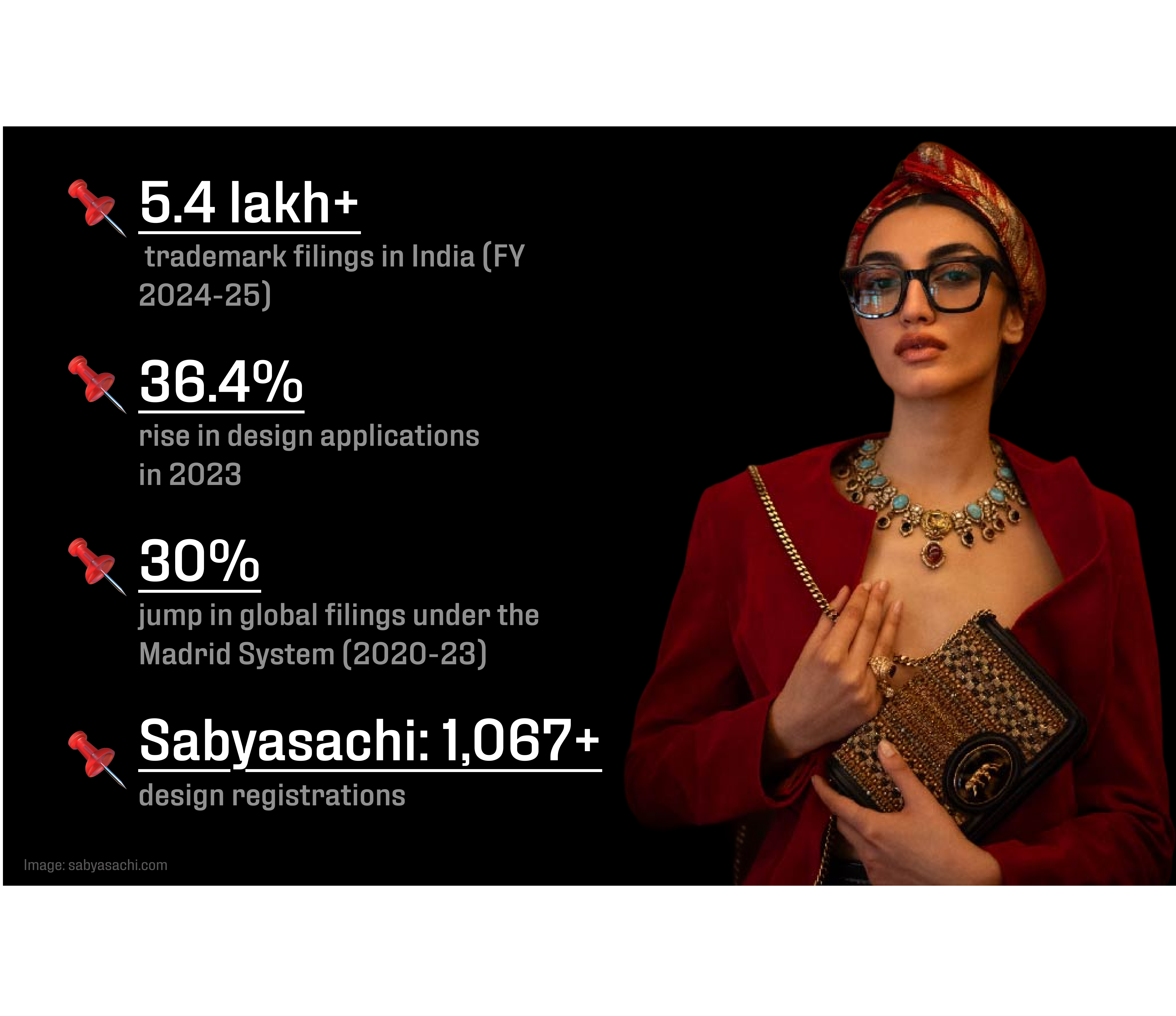

In 2017, Rohit Bal became the first Indian designer to copyright an entire collection, setting off a ripple effect that saw peers like Anju Modi and Anita Dongre follow suit. By FY 2024-25, India had recorded over 5.4 lakh trademark filings — across all industries — marking a 9.3% jump from the previous year. In 2023, industrial design applications rose by 36.4%, spanning electronics, automobiles, fashion and healthcare. Among them, Sabyasachi filed more design registrations than any other Indian entity for two years straight, clocking over 1,067 applications. The clothing also accounted for one of the largest proportions of trademark filings in India (12.8%).

Brands are thinking globally, too. Between 2020 and 2023, international trademark filings from India under the Madrid System — the global framework that lets brands secure rights in multiple countries through a single application — rose by 30%, according to the World Intellectual Property Organization (WIPO). It signals a decisive push to lock down global markets before expansion.

At home, designers aren’t hesitating to go after copycats. In 2024, Gaurav Gupta — whose sculptural gowns have been spotted on Beyoncé and Mindy Kaling — sued counterfeiters, seeking damages of ₹2 crore per infringement.

Radha Khera, a fashion and luxury IP lawyer at Remfry & Sagar — one of India’s oldest firms specialising in intellectual property — sees a clear shift. “There’s a complete mindset change,” she says. “Indian designers are no longer seeing IP as optional or reactive. It’s central to their business strategy. They’re registering, enforcing, even filing internationally before expanding. It’s about owning the narrative for the long haul.”

PROVENANCE IS NOW PROFIT

“Indian craftsmanship has long been the best-kept secret of international fashion,” says Praachi Raniwala, a journalist and luxury commentator who’s tracked the slow reveal of India’s influence. “Now the soft power of the country is coming to the fore, not just because global brands are finally acknowledging it, but because Indian designers themselves are going global and capturing the limelight.”

Indeed, the examples keep stacking up. Rahul Mishra and Gaurav Gupta recently showing at Paris Haute Couture Week, menswear label Kartik Research (previously known as Karu Research) opening a store in New York, Dhruv Kapoor morphing into a Milan Fashion Week darling and regular — all signs that the old pipeline of ideas (from Europe) and labour (from India) is breaking.

That shift is being driven by a growing global hunger for provenance: the desire to know not just what something is, but where it comes from and who made it. It’s what made “farm-to-table” explode, taking it way beyond a mere food trend. It’s why platforms like digital farmers’ market Kisan Konnect let you scan a code to see which farmer grew your vegetables.

Indian brands are tapping into this too. Craft chocolate brand Manam Chocolate traces its cacao beans to single-origin farms in West Godavari, weaving in farmer stories and immersive in-store experiences. Spice brand Tulua highlights where each spice is grown and who harvested it, creating regional traceability as a point of pride. And streetwear label 145 East turns the humble Bengal gamcha into fashion. If India can do the same with its textiles, scents, craft, and wellness, it’s exporting products but then exporting identity, and with their powers combined, they can drive premium pricing through storytelling + authenticity; build trust + loyalty by humanising production; and create cultural currency which can be leveraged globally. Provenance has now shot from a nice-to-have to a legit business moat and a pricing lever.

The numbers back this up:

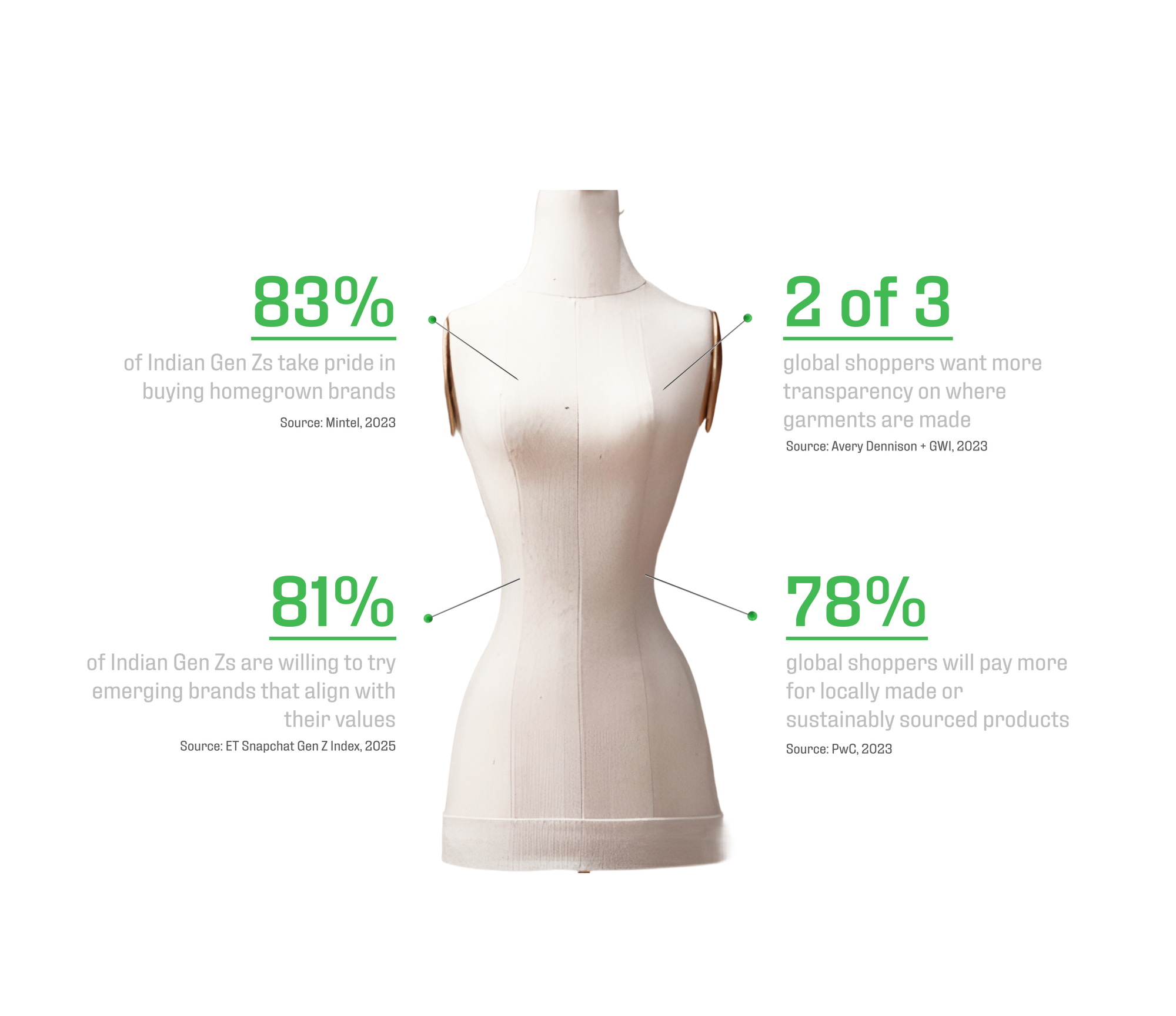

- 2 out of 3 global shoppers want more transparency on garment origin (Avery Dennison + GWI, 2023)

- 78% of consumers are willing to pay a premium for locally made or sustainably sourced products (PwC, 2023)

- More than 8 in 10 Indian Gen Zs are concerned about social and ethical issues, with 81% supporting local brands (Mintel)

- 83% of Gen Z said they take pride in buying Indian brands while 85% choose brands that hold personal meaning rather than just big names. (The Economic Times)

FROM MOODBOARDS TO BOARDROOMS

Indian design is moving beyond polite nods to “handcrafted.” It’s evolving into a sharper language of authorship and ownership — a commercial playbook as much as a cultural one.

“It always begins with narrative,” says Aaquib Wani, New Delhi-based visual artist and founder of Aaquib Wani Design. “For me, design isn’t about surface beauty; it’s about telling a story that’s deeply personal and rooted.” His Kashmiri heritage underpins projects that weave zardozi with digital installations, or reinterpret Gond art into entirely new mediums. It’s not replication of craft but its transformation and that distinction is everything.

For brands chasing “Indianness,” this is the line between cliché and genuine cultural capital. As Wani puts it, “Culture itself can’t be owned, but the way you interpret it becomes your creative IP.”

This mindset is shaping big brand moves:

- Nike x NorBlack NorWhite: A 2025 collab with Indian streetwear rooted in memory and movement

- The Dior show at the Gateway of India: Actively credited the Chanakya School of Craft and its artisans

- Louis Vuitton SS26: Invited Bijoy Jain and AR Rahman to co-create a spectacle grounded in Indian design

These aren’t surface-level gestures. They build brand distinctiveness, earn global press, justify higher pricing, and resonate with younger consumers who expect radical transparency on who’s involved and who’s paid.

THE NEW LUXURY CHEAT SHEET

India now has over 650 registered GI tags (Geographical Indications are a form of intellectual property that legally ties a product’s qualities to its place of origin), with handicrafts making up more than half. From Banarasi brocade and Chikankari to Pashmina and Kutch Bandhani, these certifications elevate craft to premium status, restrict misuse of regional names, and safeguard generational knowledge.

Top designers like Ritu Kumar, Anita Dongre, Gaurang Shah, and Abraham & Thakore now regularly work with GI-tagged materials, turning provenance into competitive advantage.

Meanwhile, design registrations are surging. These protect the visual shape, pattern, or ornamentation of products — crucial for everything from a sari motif to the structure of a handbag. In 2023, India recorded a 36.4 % increase in design applications filed abroad — marking around 2,550 more individual design filings compared to the previous year.

Meanwhile, international frameworks are catching up. By December 2025, the EU will expand GI protection to cover craft and industrial products, meaning that Banarasi or Pashmina could soon enjoy the same enforced exclusivity in Europe as Champagne or Roquefort. Practically, that means only textiles produced in the designated Indian regions using traditional methods could legally use those names on EU shelves — raising barriers for counterfeits and unlocking lucrative market premiums for authentic makers.

FROM CREDIT TO CAPITAL

This new visibility is turning artisans into co-authors and credit into currency. Wani’s studio treats craft as collaboration, not just inspiration. “Craft isn’t a raw material. It’s a form of authorship,” he says. “If we’re building our vision on their foundation, we owe them visibility, respect, and partnership.”

That philosophy is being embedded—sometimes literally—into products. Designer Shani Himanshu of 11.11 tags each pair of handspun khadi jeans with the artisan’s name. Swati Kalsi’s Sujani embroidery showcases co-creator credits in her collection notes and exhibitions. Even luxury label Jade’s Grassroot Artisans Project lists master weavers on limited-edition tags and campaigns.

“Every product tells two stories: what it is, and who made it,” says Beverly Louis, founder of Karmann, a Mumbai-based label that works with artisans to upcycle surplus fabric. “But real credit goes beyond names on tags. Our artisans are the face of Karmann — in photoshoots, on our social media, at events.”

She recounts how their maker-led storytelling once turned a simple Diwali order into a 1,000-piece corporate gifting deal. “This isn’t traditional loyalty. It’s people participating in meaningful change,” she notes.

This model of co-creation is ethical, sure, but the bottom line matters at the end of the day and this makes it effective as well. A 2024 report on apparel supply chains found that 65% of global consumers say they’d switch brands for more transparency on who made their products. In a climate where cultural missteps can lead to rapid backlash, embedding credit on labels, in campaigns, and across digital channels safeguards not just stories, but bottom lines.

GET IT RIGHT, OR GET LEFT BEHIND

Cultural missteps now carry real risk. “Even the biggest names aren’t immune to rookie mistakes,” says Amandeep Kaur, stylist and creative director. “Prada not crediting Kolhapuri-style shoes felt like a huge misstep. Even Gucci’s sari-inspired dress on Alia Bhatt at Cannes missed the mark. Crediting the cultural roots behind designs that make these brands millions is honestly the least they can do.”

“The difference between inspiration and extraction,” Wani reminds us, “is credit, collaboration, and compensation.”

SO, WHAT NOW? A NEW PLAYBOOK FOR BRANDS

For brands, the opportunity is immense. But so is the scrutiny. Get it right, and you’re part of a powerful new story. Get it wrong, and you’re just another footnote in a cautionary tale about who profits off a culture they never built. Here’s how smart Indian brands can turn culture into capital:

- Codify your IP early: File design registrations, trademark distinctive elements, and secure GIs wherever applicable. Don’t wait till you go global; protect your brand language now.

- Centre the creator as well as the craft: From campaigns to collection notes, put artisans on your platforms, name collaborators, show the journey and not just the end product.

- Don’t extract culture; participate in it: The old playbook of borrowing freely and hoping no one notices is collapsing under the weight of a sharper, more connected, and culturally aware global audience. As Louis puts it: “Pay fair wages, credit by name, share profits. Authentic cultural products created by people who genuinely understand the tradition will always outperform surface-level interpretations.”

- Move from surface to story: Generic “handcrafted” won’t cut it. Craft recognisable design signatures—motifs, weaves, scents, sounds—that consumers associate with your label.

- Demand credit in collaborations: Whether you’re the local partner or the global giant, structure deals that treat you as a co-author, prioritise visibility and shared value.Build community through transparency: Consumers want to know where their clothes come from and who profits. Show them. That’s good optics but also, in today’s world, good business.