Coffee is no longer just a functional beverage — it's a trendy, new lifestyle accessory, all thanks to Gen Z.

By Ahaana Khosla (LinkedIn ; Instagram)

Experts:

- Meghna Kaur @shetroublemaker (Lifestyle Creator & Co-founder)

- Akash Thakkar (Co-founder)

- Naheel Koroth (Co-founder)

- Radhika Seth @radhikasethh (Lifestyle Creator & Co-founder)

TL;DR:

- Thanks to an increase in disposable incomes, urbanisation and variety of brews, over 44% of the Indian population drinks coffee.

- One in five Gen Zs and millennials follow the suggestions of influencers when choosing what coffee to buy.

- 65% of specialty coffee drinkers in India are millennial or Gen Z.

India was one a primarily chai-drinking nation but, as of 2023, more than 44% of the population drinks coffee thanks to an increase in disposable incomes, urbanisation and variety of brews. But there’s another cultural shift brewing under the surface – the way India drinks coffee is changing too. What was once a niche beverage for corporate office-going adults (50% of Indians drink coffee at work) has become a trendy lifestyle statement that signals identity and status – and younger consumers behind it all.

“Cappuccinos were an aspiration. But iced coffee is an identity – it’s quick, aesthetic, and fits how this generation lives: on the move, online, and unfiltered,” says Radhika Seth, lifestyle content creator and one of four co-founders of Naked, a coffee brand focused on marketing to Indian Gen Zs where emphasis is on aesthetics, vibes and convenience. In fact, according to a 2024 Deloitte report, one in five Gen Zs and millennials (22% and 21% respectively) follow the suggestions of influencers when choosing what coffee to buy.

As India’s coffee culture evolved, the drink became overintellectualised – brands marketed it less as a functional pick-me-up for tired adults and more as an artisanal, high-concept beverage that needed a jargonic understanding of notes, roasts, grinds, and brewing equipment. In a 2022 interview, Rahul Reddy, founder of Subko Coffee, said, “Coffee is complex and layered similar to wine, and in order to do each lot justice, it must be treated independently, roasted the right amount for the unique flavour profiles and notes to come out and sing.”

Naked co-founder Akash Thakkar says that while reports show that coffee consumption is growing in India, people still find its technicalities overwhelming, which can deter them from entering the specialty coffee world. The brand’s third co-founder Naheel Koroth agrees, adding, “There will always be a set of coffee lovers who obsess over roast levels, altitudes, and origins and that’s great. But our audience is the growing group discovering specialty coffee for the first time. We wanted to make that entry point less intimidating and more enjoyable, while still giving them great quality.”

Influenced heavily by social media trends and global preferences, younger consumers are gravitating towards sweeter, flavoured coffee and ready to drink (RTD) coffee products. For Indian Gen Zs, social media plays a central role in their brand discovery: 89% use it to share and see opinions, 83% say they try new brands based on influencer recommendations and 85% follow trend-based accounts for updates and entertainment.

“We saw a clear gap in the market for a coffee brand that was targeted towards Gen Z, fit the vibe but didn’t compromise on quality. The medium of advertising has evolved from billboards to social media and the vibe economy is very real,” said Meghna Kaur, co-founder of Naked and lifestyle content creator.

THE CONSUMER STORY

IDENTITY-FIRST MARKETING

65% of specialty coffee drinkers are millennial and Gen Z and, for generations that make purchase decisions based on who they are and want to be, coffee is now a lifestyle accessory that signals taste, identity and belonging. With 50% of them stating they seek products and services tailored to themselves, they are drawn to coffee brands that are able to offer trending formats and flavours such as matcha or coconut lattes that are “generating excitement and turning drinks into sharable moments”.

Naked taps into this desire for “sharable moments” with creator collaborations and events and experiences like invite-only preview tastings designed as much for the camera as for the caffeine fix. The brand’s ability to feel international and premium while still focussing on local sourcing adds to its appeal. It features both locally sourced beans from coffee estates like Kerehaklu in Chikmangalur alongside Instagram-friendly, trendy flavours like coconut cloud and tonic espresso and merch.

SUBSCRIPTIONS HIT THE INDIAN COFFEE INDUSTRY

Young Indians are reeling under financial instability but still finding unique ways to prioritise health: 40% now use EMIs or subscription models to fund preventative wellness expenses like gym memberships, mental health apps, and skin care treatments. This subscription-model has even proved popular in the coffee industry: reportedly, for Indian brand Bloom Coffee Roasters, subscription-based orders surged by 50% in 2024 as most consumers consume coffee at home.

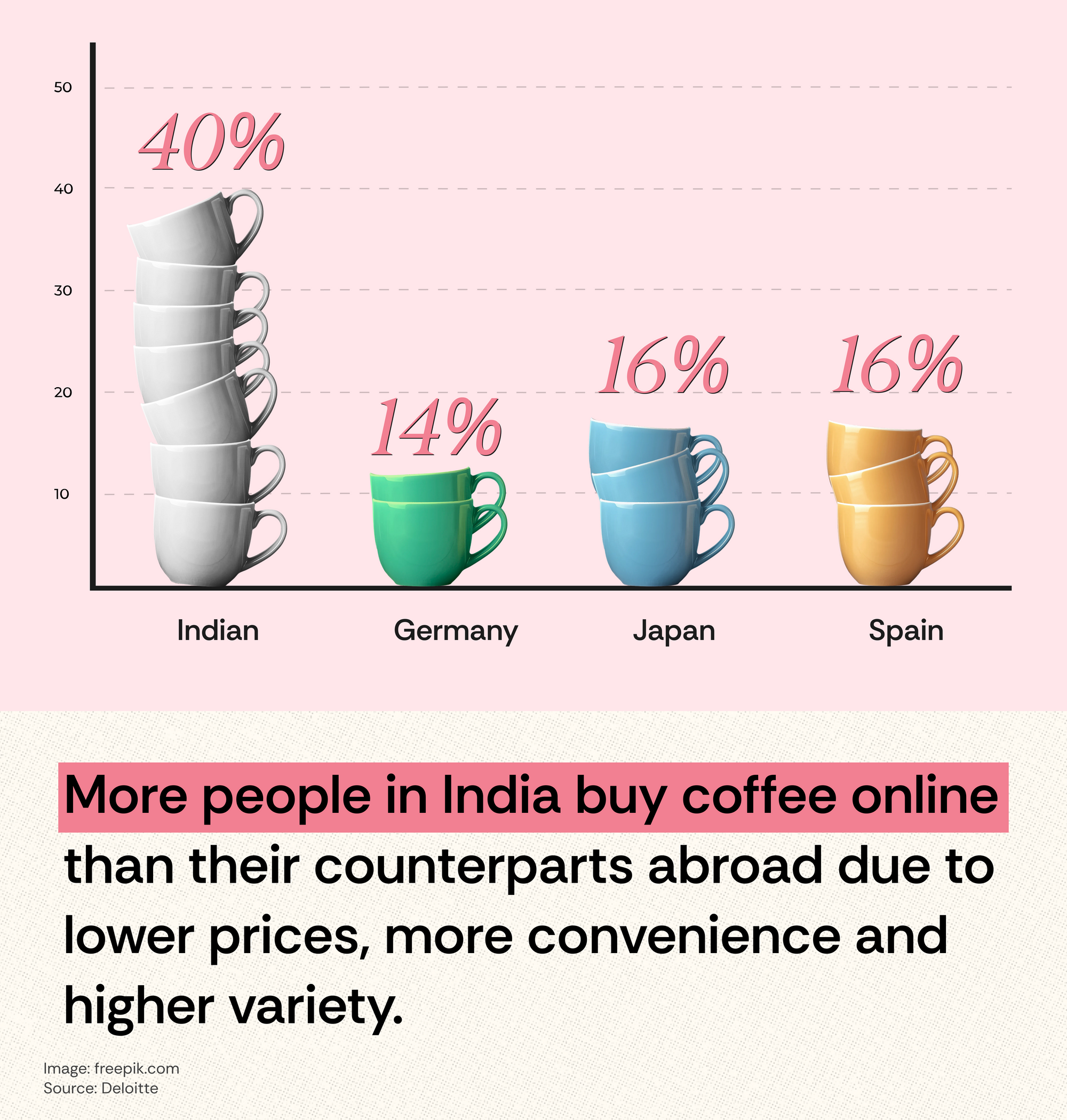

According to a global Deloitte study, 40% of Indians buy their coffee online – beating out the coffee e-commerce markets in Germany (14%), Japan (16%) and Spain (16%) – due to lower prices, more convenience and higher variety. Subscription services also reign supreme where “one in seven online coffee shoppers (15%) indicate they have signed up for regular deliveries.” Even the Coffee Board of India has tagged subscription models as a strategy to boost coffee consumption.

HOW BRANDS CAN TAP IN

THE POWER OF UGC & CREATOR-LED BRANDS

According to a report by Boston Consulting Group (BCG), over 2 million monetised content creators in India are influencing more than $350 billion in consumer spending. Creators in India are now leveraging their followings and fan bases to build brands that are extensions of themselves and cater to the needs of their hyper-connected communities.

User generated content (UGC) content is also emerging as a strong communication tool: 86% of Indian customers say they trust a brand more when it features UGC and 85% of Gen Z state that they are more likely to purchase from brands that hold personal meaning for them. “There’s so much content out there that consumers now prefer watching more ‘real’ content from creators who they can actually resonate with as opposed to those with mass followings,” said Thakkar. Young Indian consumers are becoming increasingly difficult to capture and build loyalty with. In order for a brand to truly become embedded in their lifestyles, they must feel genuinely connected to it.

REMIX WESTERN AESTHETICS WITH INDIAN VALUES

There is a huge opportunity for local brands to mix western aesthetics and global trends with Indian sensibilities to create brands that feel both familiar and aspirational. “India definitely takes inspiration from the West but we remix it our way,” says Koroth. Other F&B brands like Bombay Sweet Shop, Indu Ice Cream and Paper Boat are also nailing this strategy by blending nostalgic flavour profiles with packaging and marketing that feels modern and relevant to global sensibilities. “What’s emerging is a uniquely Indian, vibe-driven coffee culture that is bold, young and unpretentious. While we’re just getting started, the best part is it feels authentically ours,” says Koroth.

Ahaana Khosla is a trend forecaster, cultural strategist, writer, and editor with a background in fashion, beauty, and lifestyle journalism. She writes about consumer behaviour and emerging trends with bylines in Vogue Business, Vogue India, Harper’s Bazaar UK & India, and BeautyMatter. Ahaana is also the founder of Foresight Forum, a platform dedicated to decoding the future of fashion, beauty, and hospitality through sharp insights and accessible storytelling. Her work bridges global perspectives with local relevance, helping brands and creatives stay ahead of the curve.